Communications & Business License Manager: Katie Sizemore

Phone: 864-843-3177 ext 4

Email: Ksizemore@libertysc.com

City of Liberty

ATTN: BUSINESS LICENSE

PO Box 716 / 119 West Front Street

Liberty, SC 29657

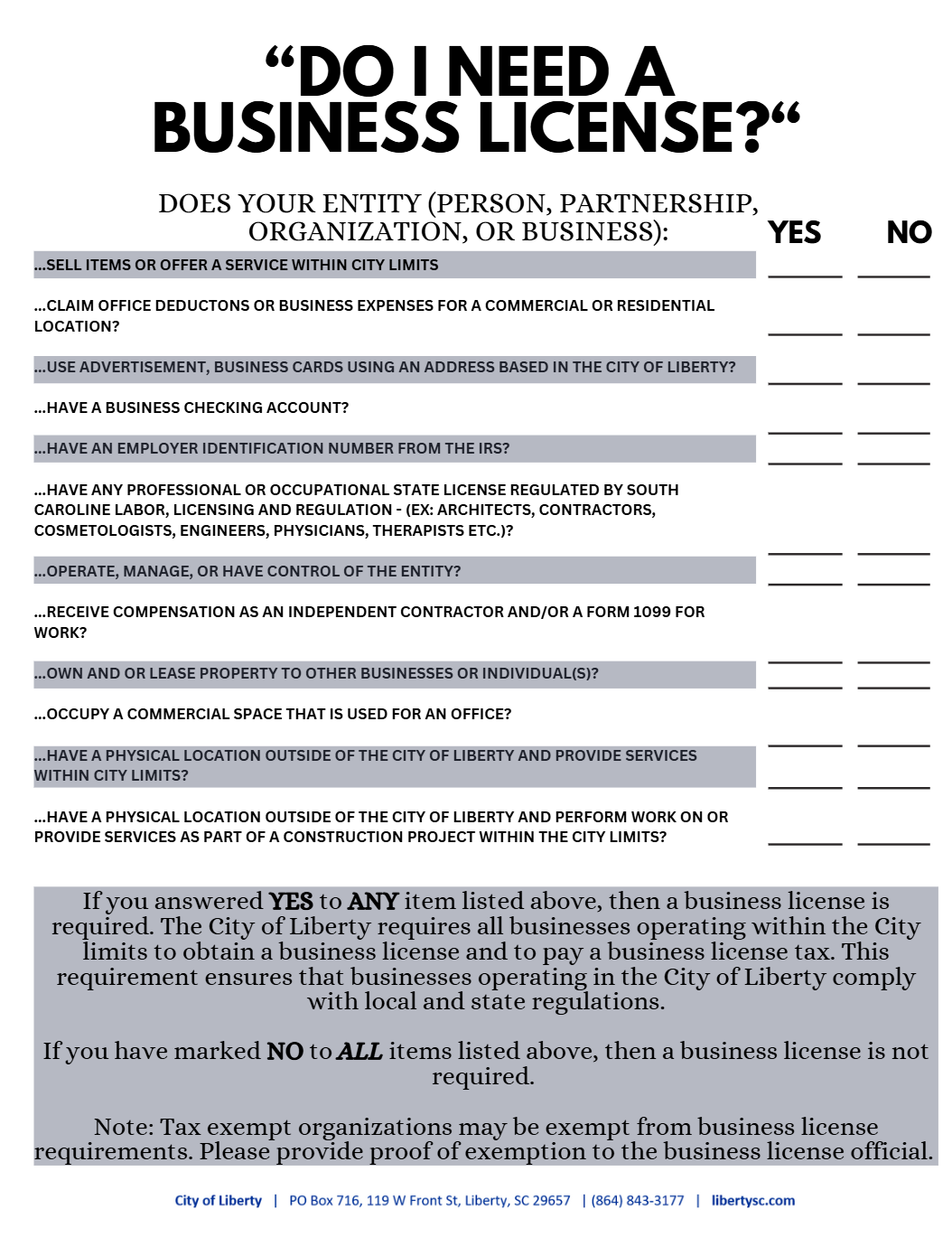

A business license tax is neither a property tax nor an income tax. Rather, it is a way of requiring an entity or individual doing business within a municipality to contribute its share in support of the city. According to state law, municipalities have the authority/permission to impose a tax on the gross income earned by businesses operating within its jurisdiction.

In most cities, 25% – 50% of their general fund budgets come from the business license tax, and there is no alternative revenue stream to replace it. City leaders have little flexibility in raising revenue because of Act 388’s millage and reassessment caps and restrictions on the use of other revenue sources such as hospitality and accommodations taxes, thereby making the business license tax a critical revenue source.

No online payment is currently available; however, card payments may be made at City Hall or by phone. All debit/credit card payments are subject to a 3% convenience fee.

A Business License form must be completed and submitted on or before April 30th of each year.

Business licenses are issued for a twelve-month period from May 1st through April 30th and the business license fee is based on the gross receipts of the business from the previous calendar year and must reflect the gross receipts reported on your federal and state income tax returns and your state sales tax returns (if applicable).

If the business was not in operation for the full twelve months of the previous calendar year, estimate your twelve-month projected income based on the monthly average for the business. Business owners are responsible for updating their business license application/fee if their actual gross receipts are more than 5% of the initial estimate.

If your business files your tax returns to the Internal Revenue Service/SC Department of Revenue on a fiscal year basis that is different than a calendar year, you may use your fiscal year as the basis for your business license fee. If so, please make a note of this on the application.

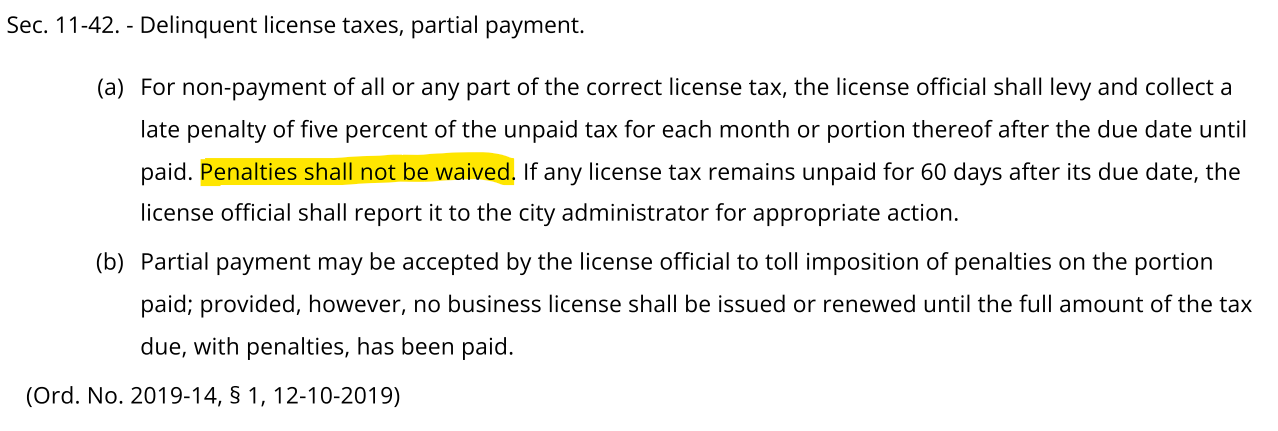

Renewal forms are due April 30th of each year. The penalty structure will begin on May 1, with a 15% penalty, increasing by an additional 5% on the first of each subsequent month. There will also be a $25 administrative fee for each year your license is late.

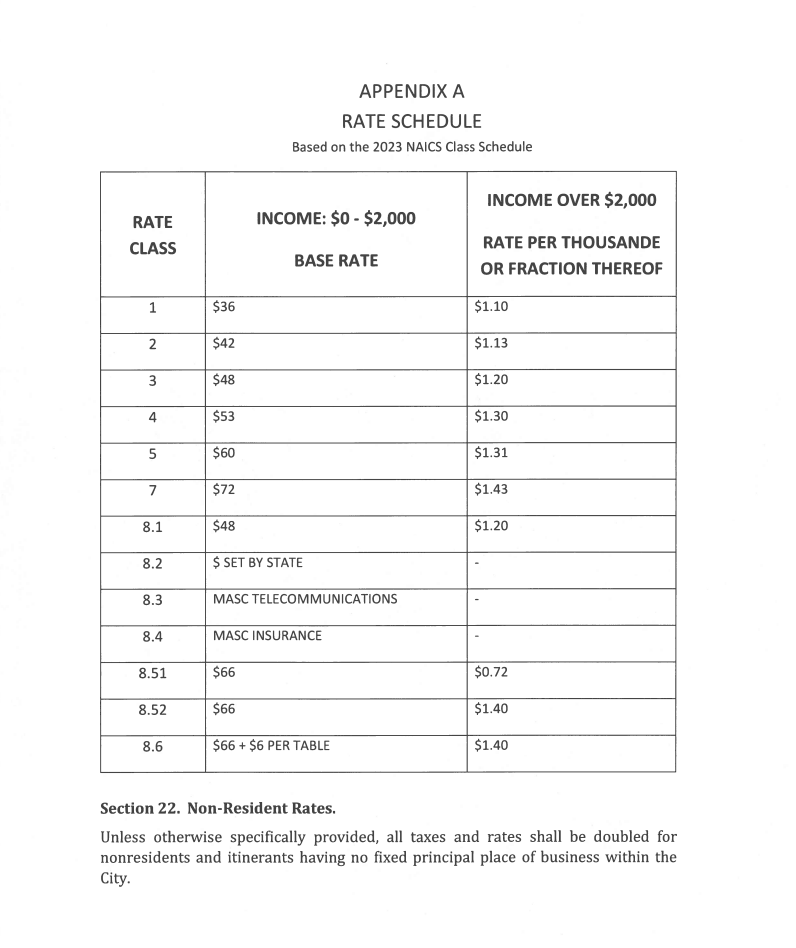

Please contact the business license official if you are unsure of your rate class.

A Business License form and associated fee must be completed and submitted before you open your business in the City of Liberty, SC. The fee for a new business shall be computed on the estimated probable gross income stated in the license application for the balance of the license year.

Means the gross receipts or gross revenue of a business, received or accrued, for one calendar or fiscal year collected or to be collected from business done within the Municipality, excepting therefrom income earned outside of the Municipality on which a license tax is paid by the business to some other municipality or a county and fully reported to the Municipality. Gross income for agents means gross commissions received or retained unless otherwise specified. Gross income for insurance companies means gross premiums written. Gross income for business license tax purposes shall not include taxes collected for a governmental entity, escrow funds, or funds that are the property of a third party. The value of bartered goods or trade-in merchandise shall be included in gross income. The gross receipts or gross revenues for business license purposes may be verified by inspection of returns and reports filed with the Internal Revenue Service, the South Carolina Department of Revenue, the South Carolina Department of Insurance, or other government agencies.

Contractors whose business is located outside the City who do business inside the City sometime during the license year may file for a business license before the construction job occurs rather than during the renewal period. Each license is issued per jobsite.

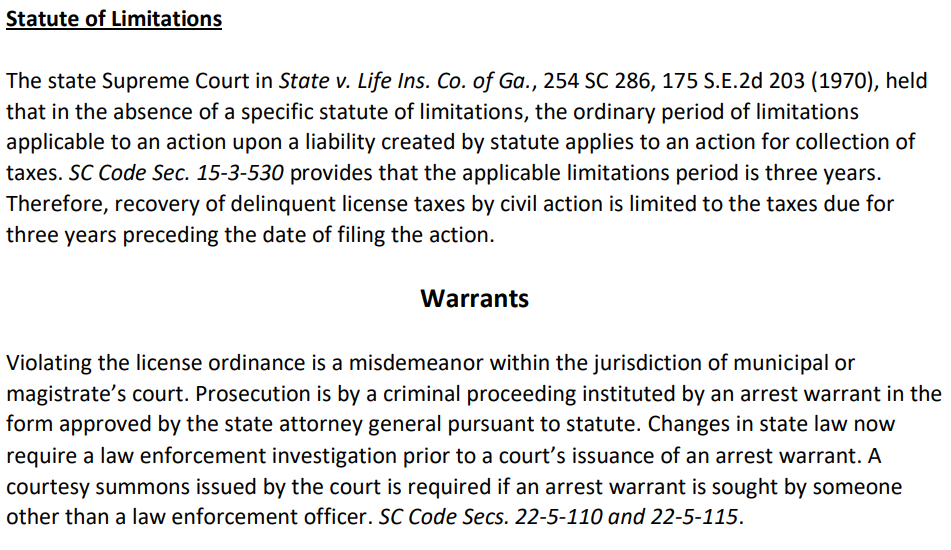

In an effort to ensure fairness to all businesses and the City, the City reserves the rights to verify gross receipts for business license purposes with the South Carolina Department of Revenue (sales & income tax) and/or the Internal Revenue Service and may require businesses to submit their federal and/or state tax forms for verification.

We thank you for being a part of the City of Liberty, SC.